Burbn was a foursquare knock-off. A location-based app that let you check-in to places, earn points for hanging out, and post pictures.

It was too complicated and had a massive churn problem. The developers started to use analytics to find out how users were using the app. They found that people didn’t bother using the check-in features at all. They only used the app to post pictures.

With that data, they decided to reduce the app's scope drastically, and in one fell swoop drastically reduced their customer churn rate. Burbn died, and in its place, Instagram was born.

Everyone in silicon valley is looking for that magic bullet, a single change they can make that will crush churn, and make all their new customers stay, content and happy with their service.

That one tip, trick, tactic? It doesn’t exist. Even if you hit the jackpot and find a single change that can kill your churn, as Instagram did, it still requires a lot of work and a lot of data.

Why reduce churn in your business

Reducing your churn is an ongoing struggle, and will continue to be for however long your company exists. But that doesn’t mean that you should give up the fight. The key to fighting churn is to develop a systematic, defined retention process, that allows you to find all the small ways, the thousand tiny little tips, tricks, and tactics you can use to maximize customer satisfaction and reduce your churn.

Finding all these marginal gains will do much more for your retention than relying on one single gimmick, and if you develop the right process, you can repeat this success constantly, continually fighting churn and growing your business.

Here are the steps you have to take to build a systematic retention process. A process that has been extensively written and talked about by Brian Balfour, VP of growth over at Hubspot. Brian's insight has given us the foundation to bring you actionable insight from generating ideas, to prioritizing, testing and analyzing. Following these steps can help you chip away at your churn rate every single day.

Reducing churn is the key to growth

A great retention rate is the sum of all the small gains you can make. You’re not going to get a 50% decrease in churn in one fell swoop, but you will find small changes you can make all over your product, service and company that will each reduce your churn. This won’t reduce churn overnight, but it will chip away at your churn rate and slowly help build your company towards growth.

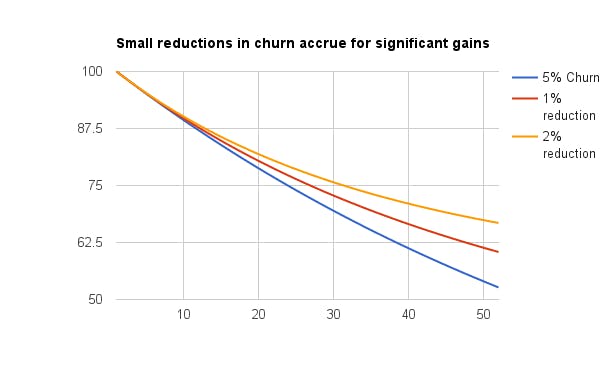

Here’s what 3 retention curves look like — one with a continuous 5% monthly churn, one where that churn rate is reduced by 1% every week, and one where its reduced by 2% each week:

Even the tiniest changes in churn rate will have an effect. The blue line will always continue down to 0, whereas even 1% or 2% changes in the churn rate mean that red and orange lines will eventually level off, and start to curve upward into net negative churn.

Churn is basically the bane of any subscription company’s existence. After you do so much work with customer acquisition, establishing the value of your product and attempting to monetize them at an appropriate level, all of that energy is lost in one fell swoop to your customer leaving you.

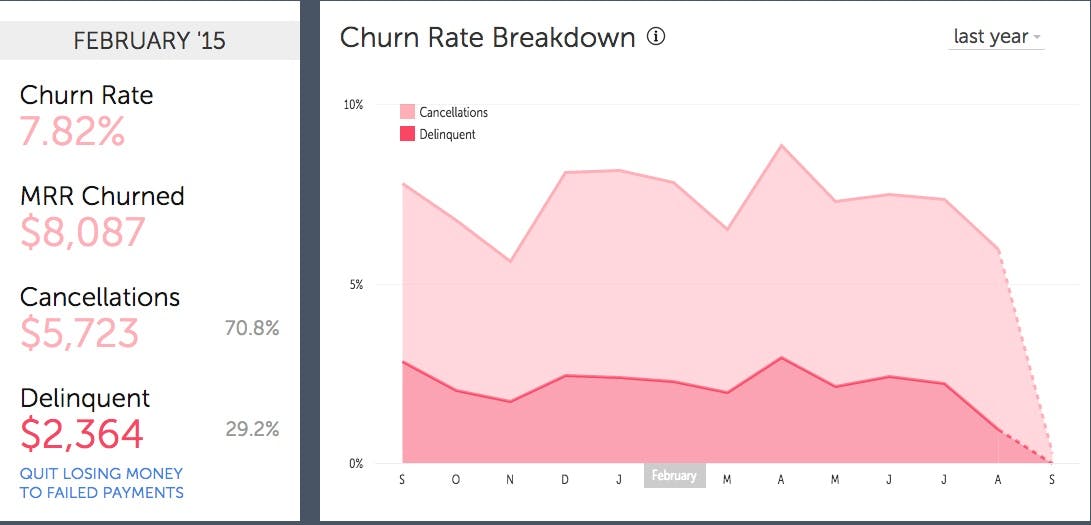

While there are a multitude of reasons for churn, they fall into two main categories: active cancellations and delinquencies. Active cancellations occur whenever a current customer actively chooses to leave your product, whether it’s because they didn’t see the value, get their support ticket answered, or simply just don’t need the product.

While active cancellations are explainable and controllable in some manner for the most part, delinquencies are a bit trickier. While a good number of delinquencies occur because of expirations or credit card limit failures, the vast majority occur for much more obscure reasons. Hiccups in the credit card processor, new security protocols, and even false positive charge denials can all trigger a failure.

The double-edged sword of the compounding nature of the subscription revenue model is that you’re likely not losing out on one month of a customer’s revenue, you’re missing out on almost the entire lifetime value of the customer.

How to reduce churn in 5 steps (with examples)

Most companies approach reducing their churn in an ad-hoc manner. They try a bunch of random tactics that they’ve heard worked at other companies, jumping from one to the other. All they’re hoping to do is get lucky and win the retention lottery.

Churn is a multifarious, beguiling problem. There’s tons of reasons why your customer base could be churning. In order to strike at the root causes of churn, you have to break it down into smaller, manageable pieces.

In SaaS in particular, your business will be constantly evolving and changing, and new avenues for churn will continually appear.

That’s why you need to build a process that reduces churn, not just to try and reduce churn one issue at a time.

Here are 5 steps to reduce churn via a rock-solid retention process, inspired by Balfours approach along with Price Intelligently data and insight, that will chip away at your churn rate in every area of your business.

You need to set the goals for your experiment, then drill down into the specific questions you need, before analyzing the results to see how they fit with your objective, and then refining and repeating the process to turn your churn rate negative.

1. Define your churn goals

Before you go charging into your product and changing things, you need to define a goal for the process. In terms of retention, your overall goal is to reduce churn, but to make this actionable you need to both quantify this goal and break it down further into smaller goals, corresponding to the 3 stages of churn. For instance:

Setting goals allows you to measure your progress through your retention process as you loop back from individual experiments, as well as set an end-point for the process. You set the goal at the start so everyone on the team knows what they are aiming for, and what you want to accomplish.

Once you’ve set these goals, then you can start the process of looking over your existing data and feedback and defining the questions you need to ask, and designing the right experiments to answer them.

Example of churn goals in action: Mention

Mention allows people to track what is said about them online. As the service grew from a few hundred to a few hundred thousand, the company found that its current communication strategy was failing, and customers were churning as a result.

The company set a specific goal of reducing churn by 20% in 3 months.

They actually surpassed their goal in just one month, reducing churn by 22%. They did this through optimizing their support strategy, prioritizing trial and paid customers over free customers, as well as hosting webinars, and developing an automated 'nurturing’ tutorial program to activate and convert trial users.

Setting a goal and hitting it so early meant that Mention could use what it learned to go further, using the time freed up from optimizing their customer support on learning more about the customer journey experience.

2. Ask the right questions

When deciding what questions you’re going to ask, you want to drill down to specifics as much as possible. You want to brainstorm ideas for reducing churn in the short term, during the first few months of use, then brainstorm separate ideas for reducing medium term churn, then long-term churn. You can also segment customers by how they use your product, and target specific experiments at them.

The further you narrow the scope and the more specific you get, the easier it will be to come up with actionable questions and concrete ideas you can test.

For your process to work, you need to generate the right questions. You’ll have a good idea of what areas of your company are causing churn problems from user feedback and internal data. However, relying on just that might mean that you are missing the bigger picture.

In his book The Innovator’s Solution: Creating and Sustaining Successful Growth, Clayton Christensen sets out 4 ways you can generate the best ideas for growing your business.

- Observe - You can closely observe both what your own customers are doing, and what other companies are doing:

undefinedundefined - Question - To find the exact questions you want to ask, Christensen suggests going through all the questions that come to mind when discussing the topic. All of the Whys, Whats, Wheres, Whens, and Hows that you can possibly think of that are related to the different stages of customer retention. This is the start of your question pipeline as these questions will lead to answers, which will lead to more questions, until you have the exact questions you need to answer.

- Associate - Try connecting unrelated ideas to synthesize completely new ideas. If your SaaS product is directed towards a specific market, can you use ideas within that market to increase customer retention? If you’re building CRM software for sales teams, can you look at how ideas from the sales process can help with the retention process? Maybe this idea from left field is exactly what you’ve been looking for.

- Network - Don’t be afraid to ask others about their techniques. You're not asking them for their hacks, or tactics to reduce churn, rather what they think are the right questions to ask to formulate your experiments. You need to be constantly exchanging ideas with other SaaS founders to refine your process.

Though you can ask for help, every company is different, and every product is different, with different customers and a different audience. What works for ProfitWell won’t work for the video marketing service Wistia, and vice versa. This is why silver bullets don’t work, and setting out a structure to reduce churn is the better answer.

Example of asking the right questions: Bidsketch

When Bidsketch, a SaaS that provides professional proposals as a service, was fighting churn, they chose to break down their headline churn rate into different categories of their business. They realized that they had different retention issues in their product, pricing, and marketing, with different questions that needed answering:

- How do different onboarding flows help customers discover the product?

- Are we targeting the right customers?

- Could going upmarket help reduce churn?

They experimented with new user flows for onboarding customers, different pricing plans for different types of users, and found that significant churn was coming from failed transactions. If they hadn’t broken down their churn into its component parts and experimented with the different parts, then they wouldn’t have been able to attack it on multiple fronts, and zero in on the real problem.

3. Develop your hypothesis

Once you know the questions you want to ask, you need to build them into workable hypotheses. The point of developing a hypothesis is that it forces you to think about the questions you’re asking in more detail. In particular, you have to think about the impact any experiment is going to have on churn.

Hypothesizing the impact any experiment is going to have on your churn is going to help you with your decision making, turning the multitude of questions you have assembled into specific ideas you can action and test. This is a way to understand your choices and how you can progress with your process.

By developing hypotheses, you can also prioritize ideas, through defining the probability of success of the experiment, and resources needed for the experiment in your designated timeframe.

- Probability of Success - You’re not going to set a definite probability for your experimental success, but simply low, medium, and high.

- Resources Needed - Each type of experiment you run will require different resources. They might need 1 day of engineers working, or 1 week of marketing. You need to make a rough estimate of how much time and effort each idea you have generated is going to require to get the results you need.

This is crucial to the retention process, and the hardest part, especially if you’re a small SaaS business, or just starting to develop a retention process. When you first run through this process and start developing questions, it will be difficult to gauge the impact of an idea or correctly define your resources. People often overestimate the probability of success of an idea and underestimate the resources needed for that success.

But the more times you run through this process, the better you’ll get at estimating the time and resources that an experiment will take, and the more data you’ll have to back up your probabilities and impact. This means that on each iteration you’ll get better at your process and make larger retention gains.

The ideas and questions you have are going to fall into multiple categories. For instance:

- High Impact, Low Probability, High Resource: These are the 'magic bullet’ hacks. They might reduce your churn drastically, but are unlikely to work and will take up a lot of time and talent. They should be low down your list of priorities.

- Low Impact, High Probability, Low Resource: These are the ideas that should be high on your list. You can run through them quickly with little effort, and will yield results. Though those results might be small, you can get a number of them to all add up.

The main gains come from those low resource, small impact ideas. These are the ideas and experiments that you can move through your process quickly, generating data and learning. Though you might have some high impact ideas as well, if you are going to move forward with them, then they need to have a high probability of success for you to prioritize them ahead of other experiments.

When you have a list of ideas to reduce your churn, you then have to think about ways to implement these so that you can collect the data needed and see if they have the impact that you hypothesized.

Example of hypotheses in action: Bingo Card Creator

Patrick McKenzie, creator of Bingo Card Creator, a language aid for elementary teachers, noticed that there were significant drop offs in usage at every stage of the funnel for creating, customizing, and downloading the cards.

He hypothesized that users weren’t aware that the cards would only take a few seconds to create, and believed instead that the process would take a long time. They churned. He created an experiment to test this hypothesis, adding in a progress indicator so the teachers knew where they were in the workflow. This small change increased completion rates from 82% to 90%.

4. Test & analyze your ideas

Here, every company is going to be different, and every experiment will be different, but what is important is to get the minimum viable test up and running as quickly as possible. Don’t overthink the experimental design or over-engineer a solution. You are looking for quick results, so you can learn from them and move on, either refining that experiment or moving on to the next.

It’s vital here that you invest in analytics that’ll actually help you measure and analyze what happened. A common issue is for people to tweak their products and services, but not to do the grunt work of wiring these changes up to any analytics to measure how their customers are now interacting with the service.

Instead, they decide just to eyeball it, because they “know what’s gonna happen.” This is the exact opposite of what needs to happen. If you are building a process, you need the analytics in place to measure every single step your customers make so that you have the data to justify your hypothesis.

If you have that data, you can deep-dive into the numbers and see exactly where you’ve managed to make customers happy, breaking down the analysis into two questions:

- Impact - What were the results of the experiment?

- Accuracy - How close were they to the original hypothesis?

If a specific experiment increased retention, by how much? Was it close to your original hypothesis, or did the idea not have quite the impact expected?

If the experiment didn’t reduce churn, what assumptions did you make in the hypothesis that led you to think it would, and how can those be fed back into the process to improve future experiments?

This is the most important part of the whole process — it’s where you actually learn from the tests you ran and find the answers to the questions you asked. Ultimately, you’ll be looking for some reduction in your churn rate, but even if that didn’t happen at this point, you have still learned from the experiment about what you can do better next time.

Example of testing in action: Groove

SaaS help desk service Groove had a churn rate of 4.5%. Even though the company was attracting new users, this churn rate meant growth was unsustainable.

To combat it they started analyzing the differences between the number of customers who churned and those that remained active, calling these differences “red flag metrics”. By analyzing the data, they realized that it took customers who later churned considerably longer to perform certain tasks on the site. They then used this data to target users that were obviously struggling, sending them emails and offering to walk them through setup processes.

By looking at their data carefully, they reduced churn by 71%.

5. Refine, reject, repeat

Your experiments will provide actionable learnings that you can use to move your service forward. If you saw a decrease in churn, but think the same idea can do better with some tweaks, then you can refine your process and repeat your experiments, reducing churn incrementally with each new idea.

Once your experimental phase of the process is over, review your objectives, systematize your learnings, and optimize your process ready for the next challenge.

1st: Review

Before you complete your retention process, you want to perform a post-mortem on your techniques so that you can optimize the process for future iterations. Were you improving over time? Did you improve your accuracy? Did you run enough experiments?

It’s a process, constantly ongoing, and as long as you’ve done some damage to your churn rate and learned how to do even more, then you can re-adjust your goals for the next round and go again.

2nd: Systematize

For the success you had in your retention process, you can:

- Productize - If the reduction in churn came through something that can be changed in technology, this is how you should do it. If you’ve experimented with a new pricing structure, then you can now bake it in fully to your site. Anything that can be done in engineering and automated should be at this point.

- Checklists - Some things can’t be automated. If you’ve found that a new content distribution and marketing strategy has reduced your churn then that is hard to code into software. Instead produce playbooks and workflows so that the exact steps you took to reduce churn can be reproduced each time. Workflow management tools such as Process Street can simplify these procedures.

3rd: Optimize

Then you can ask the big questions. Did you hit your goals? If not, why not? If so, what can you do better next time? Once you have run through you process one time, you’ll learn so much about your service, customers, company and team that you’ll have even greater goals and even more questions the 2nd time round. Then you can zoom back in to attack different areas of churn with different ideas and constantly and continually fight churn until it goes negative, and then fight some more.

Example of refinement in action: Sidekick

When HubSpot launched their email tracking product, Sidekick, they noticed that a significant amount of users were churning out almost immediately, tracking just one email using the service. To find out why users weren’t continuing with the new product, they ran a number of experiments:

- They reduced the number of CTAs on product landing page to simplify the process: Failed

- They added example notifications for use cases to show how the product would look: Failed

- They added tooltips to help explain key features: Failed

- They added videos explaining the product: Failed

During their retention process for Sidekick, HubSpot ran 11 different experiments trying to reduce churn. They all failed.

But on each one, they learned more and more about their product and their customers. Eventually, they found that one answer was to send people back to their inboxes and away from the product once they had installed the app. This meant that they just started sending emails straight away instead of playing with the settings and not seeing the value of the service.

They weren’t reducing churn during this time but were still moving towards that goal, and by analyzing the data at each step, were able to narrow their questions and experimentation down to ideas that did eventually reduce churn on Sidekick.

A bulletproof retention process in action: Customer.io

When Customer.io, a service for sending targeted emails, were looking for ways to reduce churn they realized that one issue was they weren’t converting high quality customers. Instead, they had more low quality customers, who weren’t a good fit and churned more frequently. To combat this they experimented with concierge onboarding to convert higher quality leads.

They defined an experimental group and a control group of 200 leads each. Both experimental and control groups received emails about converting to a paid account, but when leads replied, only the experimental group received 'concierge calls’, helping them to onboard into the product, iron out any reservations that they had, and allowing the sales team to discover more about the lead and their fit with the product.

Conversion rates were almost double in the experimental group (4.2%) compared to the control group (2.2%). They then analyzed the data further, finding that concierge onboarding shortens the time to conversion, and found where this service is most effective (when people have example emails they share) and least effective (when the tool is not a great fit.)

This is a great example of the retention process in full swing:

- Goal: Customer.io wanted to keep churn low as they knew it was key to increasing their ARR to $1 million.

- Question: They brainstormed lots of ideas, using data and feedback to identify their main sources of churn, one being that they had a number of low-quality customers that churned.

- Hypothesis: They speculated that offering to walk certain customer’s through the product would lead to a) more customers converting, and b) offer customer.io a way to find out about the lead and their business.

- Experiment: They used experimental and control groups to evaluate the difference that concierge onboarding would make, they then analyzed the different groups to find out how and why this onboarding process works

- Refinement: They tried offering concierge onboarding at different times after the lead signed up, to optimize the conversions. They also continued to run the experiment, seeing how leads converted over time and where different types of customer churned out.

4 metrics that affect churn

If you're in the subscription business and you care about keeping your hard-earned customers, you'll need to start tracking these metrics.

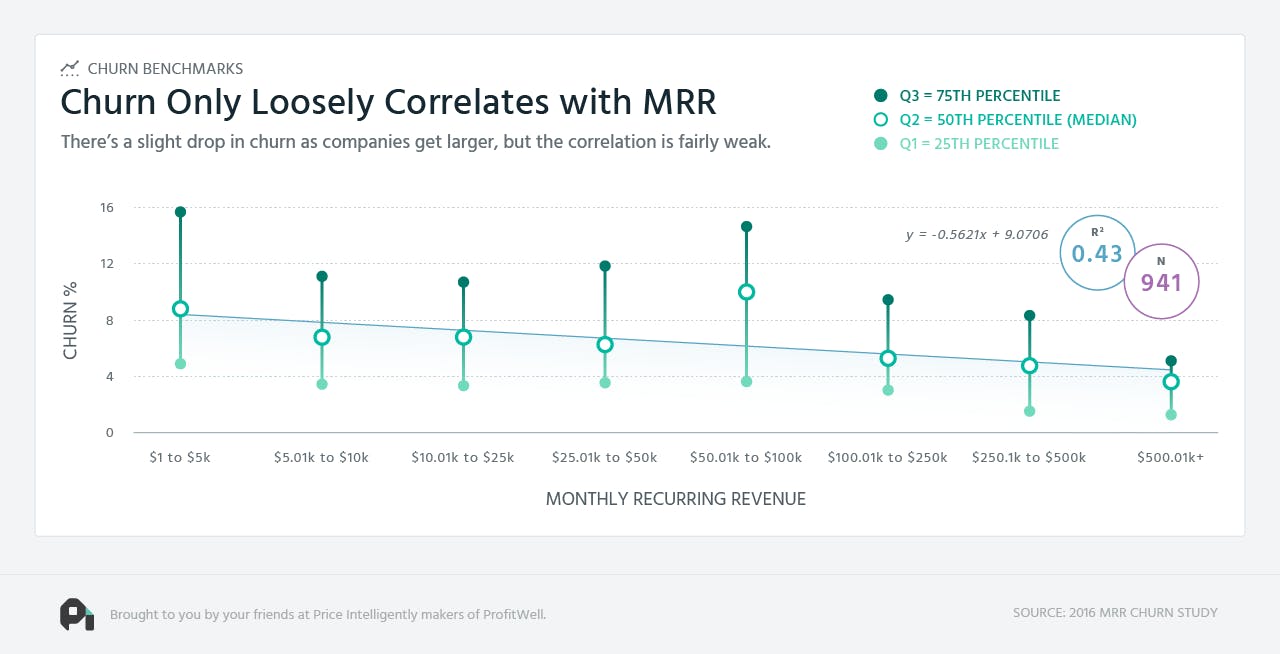

1. Churn vs. MRR: Churn only loosely correlates with MRR

First up - While we love to click and retweet articles about lowering our churn, it turns out churn is actually much higher than most companies are willing to admit and only loosely correlates with a company’s size, meaning as a company gets bigger churn tends to get smaller, but only slightly. What's especially interesting is the wide interquartile range that fluctuates between 5% to 16% gross revenue churn on the low end, and 2% to 8% on the high end.

2. Churn vs. ARPU: Higher ARPU correlates to less churn

Perhaps most telling, there's a strong correlation when comparing ARPU (average revenue per user) and churn. Single and double digit ARPU correlated with churn between 3% and 15%, whereas four figure ARPU dropped to 1% to 5%. This is to be expected, because high ARPU tends to come with a more consultative sales team, more customer success, and more attention surface area per customer.

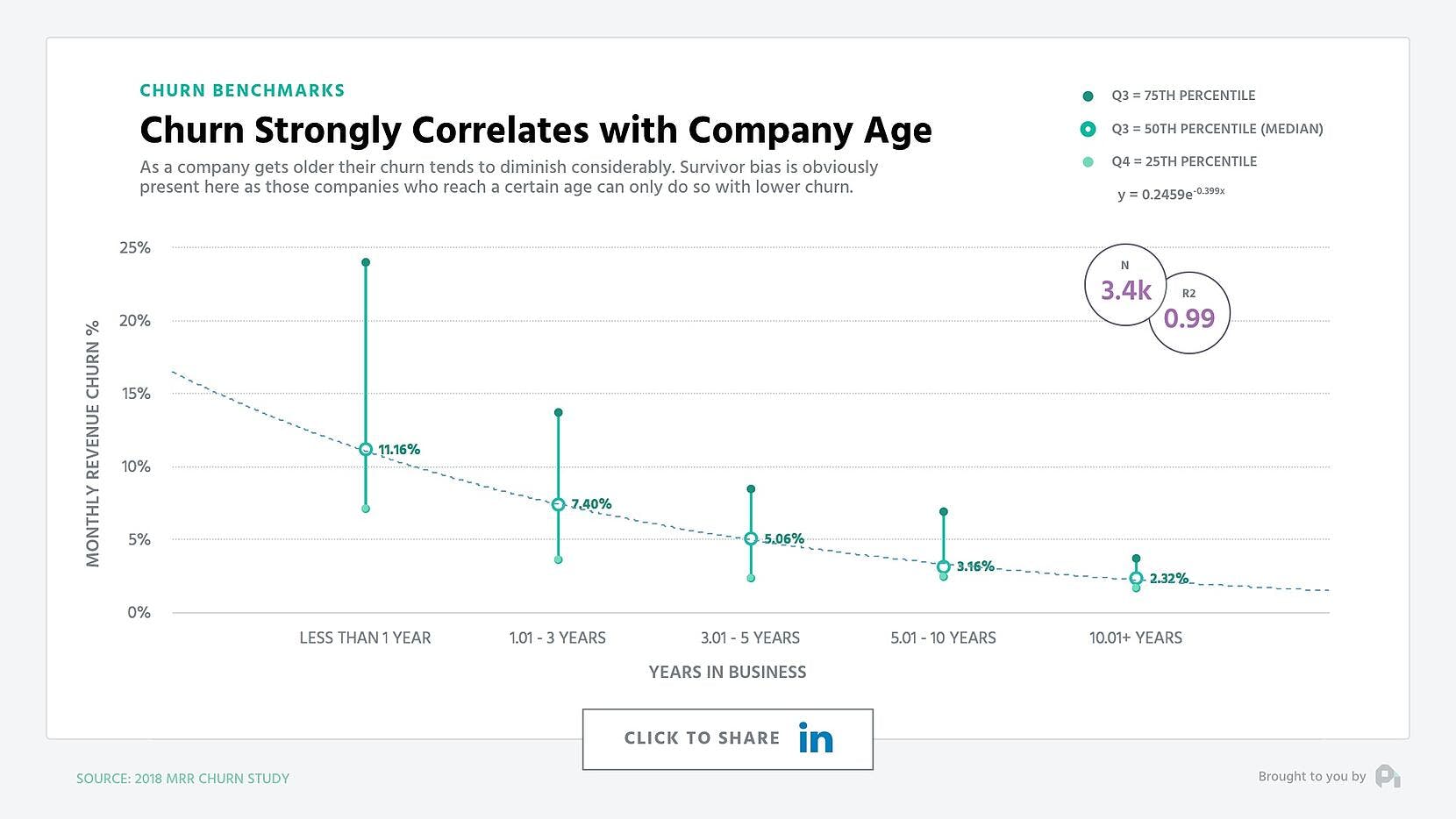

3. Churn vs. age: Older company correlates to less churn

Interestingly enough, we saw a similarly strong correlation when it came to the age of the company with companies longer in the tooth seeing significantly lower churn than those who were younger. Of course, there's survivor bias here, but you'd hope to see this when it comes to a growing company.

In fact, our data indicates that companies that are less than 3 years old can see anywhere from 4% to 24% churn, while those established more than 10 years ago report on average around 2% and 4% churn.

Let's dig into some truly actionable cuts answering what the biggest influences on churn we could find are.

Tip: Increase proportion of annual contracts

Along this axis, the first piece was really the proportion of annual contracts in the business. Regardless of ARPU, those companies with a higher percentage of annual contracts see significantly lower churn. This is because these customers have only one purchasing decision per year (albeit a larger one) whereas their monthly counterparts have 12 purchasing decisions per year.

Tip: Bring down your credit card failure rate

Delinquency rate also significantly correlated with high churn. Delinquencies are credit card failures, and it turns out 20-40% of churn is typically from delinquent churn. This churn is painful because it's completely mechanical with over 130 different reasons a credit card will fail, but most companies don't have a good solution for combatting this churn.

3. Churn vs. VC funding: Churn 20-30% higher with funding

Finally, and likely most controversially, we found that those companies with funding saw 20-30% higher churn rates than those who didn't take on funding. There's likely a number of reasons for this, but through qualitative research we've found that a likely culprit is the false sense of security that comes with the moral hazard of being able to spend your way out of growth holes. Not saying don't raise funding, but be careful and ensure funding is a tool, not a crutch or a bandaid.

Need more info on reducing churn?