MRR churn threatens your monthly recurring revenue by destroying your MRR momentum. To be successful (and emulate the most successful SaaS businesses in the world) you must calculate and optimize MRR churn correctly.

The biggest threat to your SaaS business’ success? Churn.

MRR churn threatens your monthly recurring revenue by losing users and dollars through cancellations and delinquent charges. Correctly tracking your MRR churn will allow your team to create a better product, market it more effectively, and gain momentum through compounding growth.

Successful SaaS businesses understand and calculate MRR churn properly and use that information to reduce churn and increase their revenue.

To help you join the ranks of the successful, let’s walk through why MRR churn is so important, how to calculate it, and ways you can optimize MRR churn for growth.

What is MRR churn?

Monthly recurring revenue (MRR) churn is the measure of revenue lost from customers who have cancelled or downgraded their subscriptions in a given month. In other words, it's the monthly erosion of your recurring revenue. You can define the MRR churn rate metric as an absolute dollar amount (-$40,256MRR) or as a percentage, which is more useful and much more actionable (-6.34%) to track over time.

Why is MRR churn so important for SaaS businesses?

MRR Churn’s importance exists in two main areas - product and revenue.

The importance of MRR churn for product teams

The product team should focus on reducing MRR churn rate every single month. Churn is a key indicator of the value of the product and its features. If the product team does their job well, the rate of active cancellations should get to $0 monthly.

The importance for finance & revenue teams

Your finance and operations team need to know MRR Churn to see how much MRR is being lost. This allows them to model and predict finances, including your profit, loss, and burn rate. Tracking MRR Churn over time will give them insight into how to hire and scale when customer acquisition grows rapidly.

How to calculate MRR churn

MRR churn is calculated as the difference between the MRR at the beginning of the month and the MRR at the end of the month, adjusted for any new MRR added during that month.

What to include in your MRR churn calculations

MRR churn is the sum of all the MRR lost in a given period. You lose accounts in two main ways:

Active cancellations

These customers actively choose to cancel their accounts for several reasons (didn’t like the product, can’t afford it anymore, etc.).

Delinquent cancellations

These customers officially churn after you cannot bill their credit cards. Typically you don’t count them as officially churned until your billing system has attempted to complete the charge a number of times over several days.

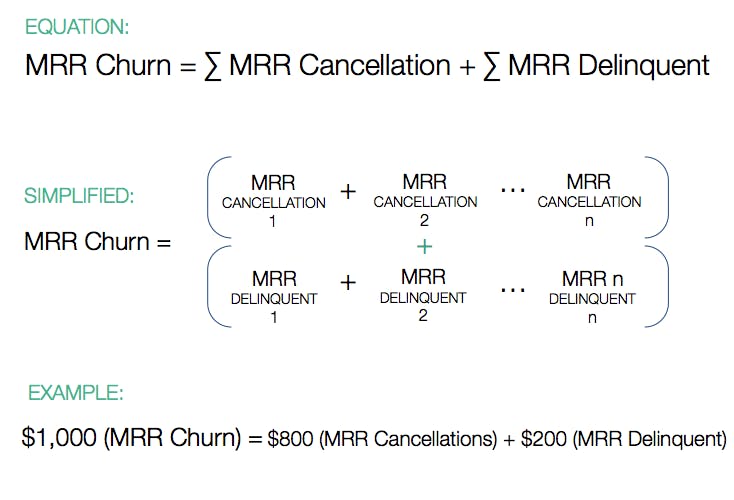

The MRR churn formula

Here we simply add up all of the MRR lost from cancelled and delinquent accounts in a given period. This gives us the MRR churn for that given period.

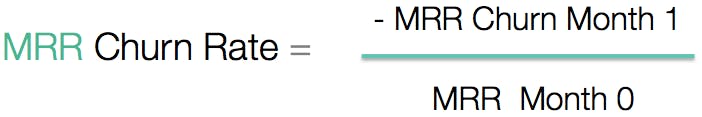

MRR churn rate formula

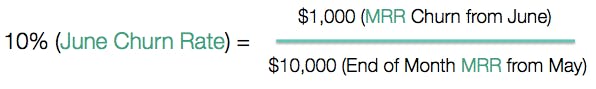

Here we’re simply taking the MRR Churn over a given period and comparing it over a previous period. As such, if we lost $1000 in MRR in June and brought in $10000 in MRR in May, then our MRR Churn Rate would be 10%.

What not include in MRR churn calculations

There’s a debate in the SaaS community about whether or not you should include expansionary and contractionary MRR (upgrades and downgrades) in this calculation. The problem with doing this is you begin to mask the gross MRR that’s leaving your business and the momentum at which it’s leaving.

This is why you should not include these aspects of MRR in this calculation, and instead look to your Retention MRR as the “God” metric for retention revenue. As a result, MRR churn then allows you to know exactly the amount and rate at which cash is actively leaving your business to optimize accordingly.

Four ways to reduce MRR Churn

MRR churn and its respective rate are designed to help you optimize and strengthen the areas that are causing customer attrition. In that realm, here are a number of the main axes to focus on to reduce this number as much as possible.

1. Implement a delinquent credit card dunning system

We’ve found that roughly 20-40% of MRR churn across SaaS is because of failed credit cards. That’s an enormous piece of low-hanging fruit given it is simply a customer’s expired credit card. Simply putting a system in place to recover these numbers is immensely valuable. Shameless plug that Paddle has a system for this that you can set up with one click.

2. Increase your active users

Increasing your active users is easier said than done, but many active cancellations come from individuals who don’t get hooked into habitually using your product. When they see an invoice for something they aren’t using, they’ll have a higher propensity to cancel.

3. Fix your pricing

Our pricing strategy research at Price Intelligently shows that improper pricing heavily influences why folks churn out. After all, if you’re aligning your product to the value that a persona sees in the product, you shouldn’t be losing those customers. Read more on value-based pricing here.

4. Run churn loss surveys and conversations

There are likely many reasons folks are churning, from missing features to bad support experiences. You should have a product development process in place to identify these reasons. Churn surveys work well for many SaaS companies. These surveys ask customers to choose the biggest reason they’re churning and the smallest reason they’re churning. These are exceptionally powerful because they allow you to pinpoint your biggest areas of opportunity. Read more about relative preference campaigns here.

MRR churn FAQs

How is MRR churn different from customer churn?

MRR churn measures the lost revenue from customers who cancel or downgrade their subscription plans, while customer churn measures the number or percentage of customers who cancel or leave a business.

Why is MRR churn important for subscription-based businesses?

MRR churn is an important metric for subscription-based businesses because it directly impacts the company's revenue and growth potential. A high MRR churn rate indicates that a significant number of customers are leaving or reducing their subscriptions, which can lead to a decline in overall revenue.

What is a good MRR churn rate?

The ideal MRR churn rate will vary depending on the type of business and industry. However, as a general rule of thumb, a good MRR churn rate is typically less than 5% per month.

What are some common causes of MRR churn?

Some common causes of MRR churn include poor customer experience, inadequate product features, pricing concerns, lack of value or relevance, and competition.

How often should businesses track and monitor MRR churn?

Businesses should track and monitor MRR churn regularly, ideally every month, to identify trends and make informed decisions.