Annual recurring revenue is a crucial success metric for subscription companies. Learn why it’s important and how to calculate it correctly.

Metrics – with the right context and understanding – are powerful tools. They help you frame the success of your business, lead to stronger forecasting, and propel your company's growth strategy.

For subscription companies, like most SaaS businesses, annual recurring revenue is one of those metrics. It gives you a high-level overview of your business health and helps you calculate the rate at which you need to grow to keep building on your success.

Yet, we've found that even though this momentum metric is seemingly simple to calculate, a lot of SaaS companies are calculating their ARR incorrectly. In fact, we found in a poll of 50 SaaS companies that 2 out of 5 were including or discluding something they shouldn't be in their annual recurring revenue calculations.

Not calculating your MRR/ARR correctly can cause you to mislead your investors/team/advisors or worse: misjudge the true health and trajectory of your business. So let's take a look deeper into why MRR/ARR is important, how to calculate it, and most importantly how to optimize it so that you are getting the truest picture of the health of your SaaS company.

What is annual recurring revenue (ARR)?

Annual recurring revenue is the yearly value of revenue generated from subscriptions, contracts, and other recurring billing cycles. ARR is one of the primary metrics used for measuring the year-over-year growth of SaaS and subscription companies that use a recurring revenue model ARR is also the annualized version of monthly recurring revenue (MRR) representing revenue in the calendar year.

Four reasons why understanding your ARR is so important

To track the health of your subscription business over time, you need in-depth knowledge of the company's current financial standing and how you're stacking up to yearly growth goals. Whether you're re-evaluating product-market fit, planning for new feature releases, or doubling down on expansion revenue, knowing the real-world impact of your decisions is paramount.

ARR is one of the best ways to find that:

1. ARR provides a figure for tangible growth

As a momentum metric, ARR gives you the purest measure of how your annual recurring revenue compounds over time. Use it to map out the best and most efficient path forward for your company and easily see the impact of the changes you've made on a year-over-year basis. ARR acts as the compass you can use to track growth.

2. ARR allows you to forecast future revenue

ARR is the baseline on which you can build more complex calculations. By cross-referencing your churn percentages, acquisition goals, or potential changes to pricing and packaging against ARR, you're able to build a reasonable picture of what success looks like in the future. Without ARR, you'll never be able to understand the real customer impact of the choices you make for the company.

3. ARR enables you to set realistic goals

You're not a fortune-teller, but a strong understanding of your company's ARR is as close as you'll get to a crystal ball. This metric provides you with valuable context for future decision-making. With it, you can see areas of opportunity in your current business model and know what actions will have the greatest effect. Should you prioritize acquiring new customers? Upsell the existing ones? This helps you make more realistic long-term (but also short-term) plans that you can actually follow through on.

4. ARR shows a subscription business's overall health

We know that subscriptions are the crux of your business model. Tracking the total yearly dollar amount of those subscriptions is the only way you'll know exactly how much revenue your company is making. By including only the real revenue generated through your subscriptions, you create the most accurate picture of the health and success of your business.

How to calculate ARR

To calculate ARR you need to account for all recurring revenues within your subscription business. As a fundamental metric for contextualizing your overall growth and the momentum at which you can scale, a few different factors come into play. Put simply, you calculate ARR by subtracting the amount of revenue lost from cancellations from the revenue generated by yearly subscriptions and upgrades.

The ARR formula

The ARR formula is simple:

ARR = (Sum of subscription revenue for the year + recurring revenue from add-ons and upgrades) - revenue lost from cancellations and downgrades that year.

It's important to note that any expansion revenue earned through add-ons or upgrades must affect the annual subscription price of a customer. Any one-time options should not be included in this calculation.

Another way to calculate ARR is to multiply your monthly recurring revenue by 12.

(Just a little shameless plug that we do all of the calculating for you through ProfitWell Metrics. You can grab your free account here.)

Figures you need to include in your calculations

Any changes to these metrics will affect your calculations directly.

- Customer revenue per year — The basis of your ARR calculation. This is the total revenue accrued each year through annual subscriptions and renewals.

- Product add-ons and account upgrades — Any changes that increase the annual subscription price on an ongoing basis. Capture the upgrade dollars from current customers who have expanded their use of your product, especially those who have moved up to a higher level plan or who have expanded their use of your value metric.

- Product and account downgrades — Any downgrade that decreases the annual subscription price on an ongoing basis. This includes the total dollar amount of customers that have downgraded their service. This is important because downgrades represent money lost from current customers that have not churned.

- Lost revenue from customer churn — Tally the MRR/ARR that you lost from customers who actually churned, not those who've canceled. If their subscription hasn't run out yet, there's still an opportunity to change their mind or recover some of that revenue.

What not to include in your calculations

ARR is only concerned with recurring aspects of your revenue model and the churn and downgrades affecting that. It can be really easy to let some “non-recurring” items slip into your calculation. Some examples of what to exclude:

- Set-up fees

- Credit adjustments

- Non-recurring add-ons

- One-time charges

A real-world ARR example with Netflix

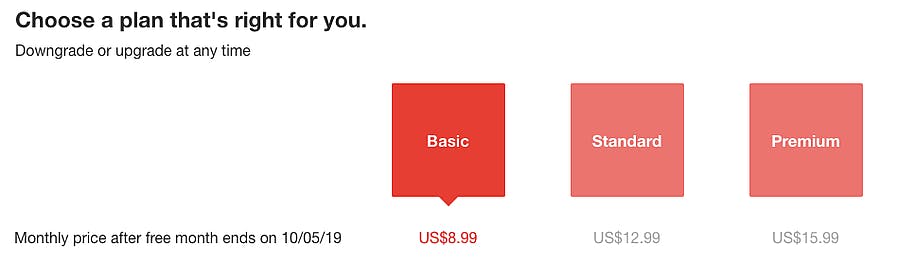

Streaming services like Netflix are some of the most successful subscription companies around. They've mastered the art of value-based pricing so well that even established media moguls like Disney have thrown their hats into the ring. But without a clear understanding of how their pricing affects recurring revenue, Netflix would have a difficult time keeping pace with their competition.

We'll walk through the ARR formula based on Netflix's pricing page to show you how easily it can break down their three-tier pricing strategy.

Netflix subscription

In this example, we'll start off with a customer purchasing Netflix's Basic plan at $8.99 a month. If, after three months, the customer chooses to upgrade to Premium, the monthly price increases to $15.99. From there, our example customer chooses to keep the Premium package for the rest of the year without any signs of downgrading or canceling.

Let's say the customer subscribed for three months before upgrading to Premium:

Total $ amount of yearly subscription:$8.99 X 12 months = $107.88

Total $ amount gained through Premium upgrade: + $7 (for a total of $15.99) per month for the remaining 9 months = $63

Total $ lost due to cancellations (churn):$0

ARR: $170.88

Let's say the customer subscribed for six months before upgrading to Premium:

Total $ amount of yearly subscription:$8.99 X 12 months = $107.88

Total $ amount gained through Premium upgrade: + $7 (for a total of $15.99) per month for the remaining 6 months = $42

Total $ lost due to cancellations (churn):$0

ARR: $149.88

If Netflix has fifty customers who upgrade to Premium after three months, that means the ARR for those customers is 50 X $170.88 for a total of $8,544.

And fifty customers who upgrade after 6 months would be 50 X $149.88 = $7,494.

You can see how Netflix's pricing strategy and their customers' choices factor into these calculations. To see the ARR for Netflix's entire service, they would need to factor in all of the different account levels, upgrades, downgrades, or cancellations within a calendar year. Following this formula, Netflix would be able to calculate the most accurate representation of their recurring revenue health possible.

Four ways to optimize your ARR

MRR/ARR is the purest view into the revenue momentum you have in your business. The more recurring revenue you generate, the longer you can continue to grow and expand your plan of attack. Keep in mind that MRR/ARR is what feeds your SaaS machine and keeps the wheels turning. Here are four actionable ways you can generate more MRR/ARR for your SaaS business:

1. Increase your net customer acquisition

You can create more MRR/ARR for your business by getting more qualified bodies through the door. Optimize your LTV/CAC ratio to a point where your customer acquisition cost is low and acquisition strategy efficient

2. Increase your expansionary revenue through upgrades and value metric

There's a lot of money to be grabbed off the table from current customers. Give them incentive to upgrade within your product by aligning the product with your value metric. Here's a bit more on how to find and optimize your SaaS value metric.

3. Increase your retention to boost your LTV

Retaining customers means that your product is aligned properly with a value metric you are in tune with your customer personas. This naturally paves the way for more MRR/ARR by expanding the width of retained customers as well as expanding the length of the customer lifespan.

4. Reduce your customer acquisition costs

SaaS business models are normally low cost from the start, and typically reducing costs is only a big deal for cost heavy industries. However let this be a last resort if you've already done everything else and still need to tweak your MRR/ARR metric to bring in more value through the door. Also keep in mind that because your costs aren't in your MRR calculation that this won't physically move your MRR number. Instead, a reduction in CAC will allow you to be more efficient with your MRR.

What is the difference between ARR and MRR?

The main difference between ARR and MRR is that ARR is calculated annually while MRR is calculated monthly. ARR represents your company's recurring revenue on a macro scale and MRR on a micro scale. Both ARR and MRR provide valuable insight into the health of your business. You can use this data to forecast how revenue will compound as your company grows and then plan what you can do with that revenue.

With ARR, you're able to see year-over-year progression at a high level, which is useful in long-term product planning and creating company road maps, especially if you run a SaaS company.

MRR dives deeper, showing you how the company grows on a month-by-month basis. This is a good way to measure the immediate effects of any changes to product or pricing strategy on renewals. It's also a way to track incremental fluctuations related to customer health at different times of the year.

Combined, you're able to more effectively plan your road map and check your progress every month. That gives you more data to inform decisions, pivot more quickly, and ultimately provide a better overall customer experience.

Final word

ARR is a key metric for any business with a subscription model. With this data, you'll be able to not only check in on the overall health of your company but also see how any actions you take either increase or decrease overall growth momentum. Recurring revenue is a compounding indicator of your ability to grow.

Being able to track these fluctuations also helps you see the best path forward for your company. The more recurring revenue you generate, the better products you can create and the better team you can build. Without ARR as the baseline, it will be impossible for your company to understand its continued success.

Annual recurring revenue FAQs

Is there an ARR formula you can use to calculate annual recurring revenue?

ARR formula is pretty straightforward: add to your total number of yearly subscriptions the total amount gained from expansion revenue, and then subtract the total amount lost due to customer churn (customers who cancelled their subscriptions). You can also multiply your MRR by 12.

Why is ARR important for SaaS?

ARR is one of the most important metrics for SaaS and subscription businesses, as it helps forecast their revenue for the coming year. Annual recurring revenue also aids in measuring the growth of your business and calculating customer churn.

What is ARR vs revenue?

ARR refers to the annual recurring revenue from subscriptions, while revenue as a general term encompasses all types of business income, regardless of whether or not it’s recurring.