Every business is interested in how much revenue they generate each month, but not all businesses have a recurring revenue model. What is monthly recurring revenue (MRR), and why is it so important to SaaS businesses?

Your SaaS business lives and dies by consistent subscription revenue. To measure that growth or decline, you’re ultimately focused on the almighty MRR or “Monthly Recurring Revenue” metric.

Yet, in speaking with 50 SaaS companies to put this post together, we found that calculating this somewhat simple metric accurately was an absolute disaster. 1 in 5 SaaS companies was removing some sort of expense from the equation; 2 in 5 were including trialing or free users in some manner; and a majority were incorrectly breaking down their annual or quarterly payments.

Although MRR isn’t part of GAAP (Generally Accepted Accounting Principles), IFRS (International Financial Reporting Standards), or reported to a government entity, not having these numbers calculated correctly means you’re lying to investors or worse - you’re setting yourself up for a potential rude awakening when you’ve realized you've misjudged and misplanned your momentum.

Let’s avoid these mistakes by quickly going through what recurring revenue is and why it’s important to your business. Then we’ll discuss how to calculate MRR, the mistakes to avoid, and one key way you can easily and clearly keep yourself on track.

What is recurring revenue?

Recurring revenue refers to a stable and predictable portion of a company's revenue where customer payments renew contractually based on an agreed-upon timeframe. Recurring revenue streams ensure higher client retention, streamlined cash flow, and a more solid bottom line. The recurring revenue business model is common for streaming services, software as a service (SaaS), and subscription businesses that collect monthly fees from their customers.

What is monthly recurring revenue?

Monthly Recurring Revenue (MRR) is the income that a company expects to receive in payments on a monthly basis. MRR is a critical revenue metric that helps subscription companies to understand their overall business health profitability by keeping a close eye on monthly cash flow.

Why tracking MRR is important

Successful SaaS companies track their MRR for two primary reasons:

Financial forecasting and planning

In the SaaS business model, you’re able to make accurate financial projections because of the subscriptions, and a large part of that is because monthly recurring revenue is relatively consistent and predictable. As you gain subsequent months of consistent revenue, you can begin to model estimates of where you’ll be and then can plan your business accordingly.

Measuring growth and momentum

If you’re on the investor-backed or take-over-the-world track, the growth in your MRR on a month-over-month time period is absolutely critical. MRR is a key indicator of the growth of a SaaS business, and the month-over-month growth percentages will clearly indicate whether you’re on a rocket ship gathering new customers and revenue or you’re still on the launchpad fueling.

How to calculate MRR

The simple way to calculate MRR is to take your Average Revenue per User (ARPU) on a monthly basis and then multiply it by the total number of users in a given month.

The formula for calculating MRR: Monthly ARPU x Total # of Monthly Users = Monthly Recurring Revenue

We break it down in more detail in the 4 steps below:

1. Align your data

Take all of the existing customers from a given month and put them in a spreadsheet with a column for their account ID (or some other unique identifier). In the next column, put their subscription value, taking any multi-month subscriptions and dividing the contract value by the number of months.

2. Sum up MRR

Next, just sum the subscription column. This figure will be that month’s total monthly recurring revenue.

3. Breakdown by cohort

The top-level information is great, but you’ll also want to break things down by type of pricing plans, cohorts, etc. Just follow the same process as above, but only include data from the segments that you're interested in.

4. Calculate MRR growth

Once you know your MRR, you’ll want to know your MRR growth as well. You can do this by breaking down the above sections into cohorts like “New MRR”, “MRR from Add-ons”, or “Churn MRR”. To get your total growth MRR, you’ll do this calculation:

(New MRR + Add-on MRR) - Churn MRR = growth MRR.

The steps above are probably a little abstract to you at the moment, so here's a more concrete example. If you have 10 customers in your Basic plan at $10 per month, and 10 customers in your Pro plan at $15 per month, your total MRR would be (10 x $10) + (10 x $15) = $250.

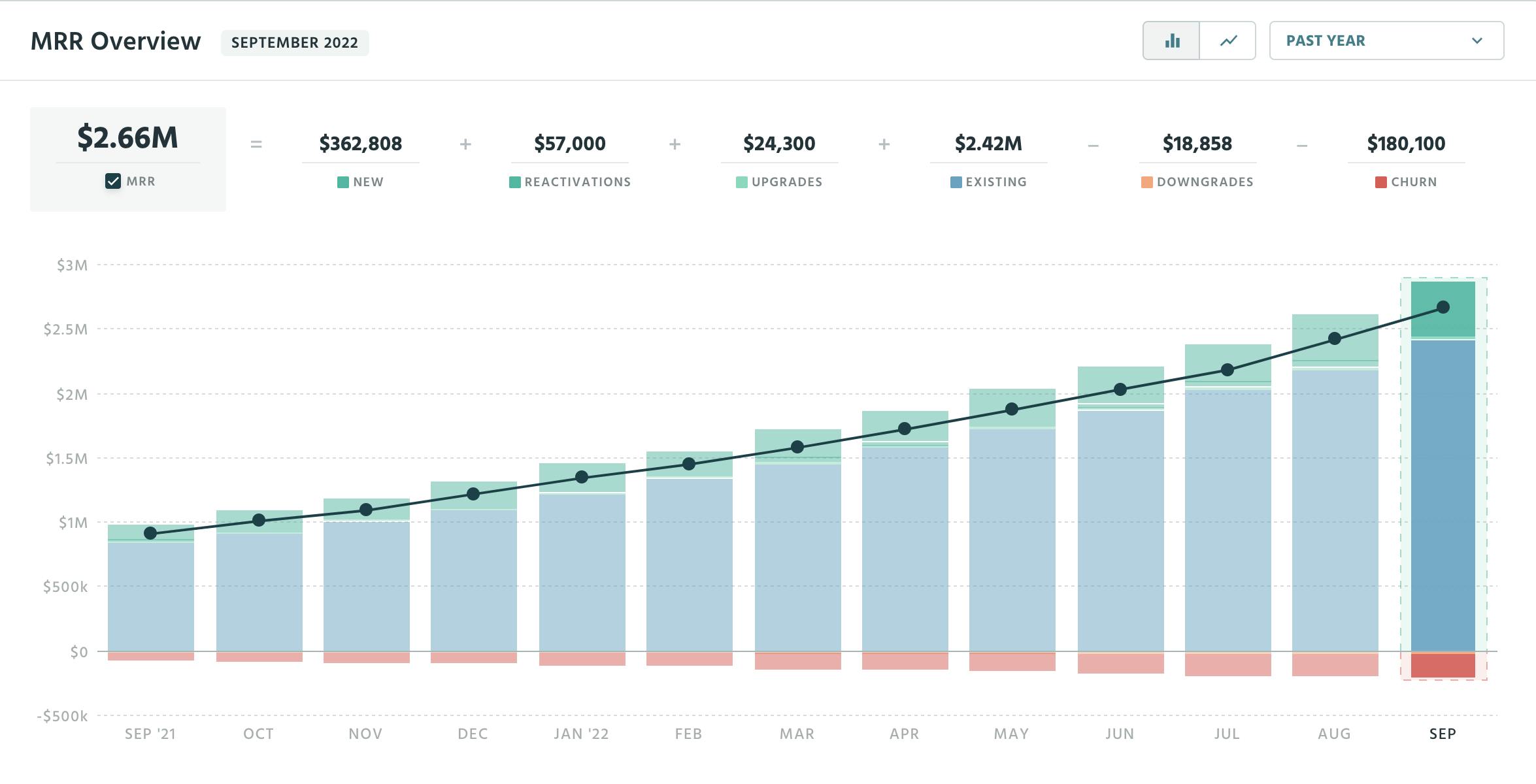

Admittedly, this can and should get much more complicated as you start to dig into your key metrics more. You’ll want to measure your expansion MRR (upgrades), customer churn, downgrades, new, etc. as below:

Yet, the larger point here is that monthly recurring revenue, especially on the top level, is purely your actual subscription value and your number of customers. Keep in mind that all of this commentary is referring to months that have already happened. When you’re cooking with gas, you’ll want an update day by day tracking your MRR, which becomes more of an issue when you’re caring about the MRR breakdown (churn, upgrades, downgrades, new, existing). We’ll save that commentary for another post.

Common mistakes when calculating MMR

MRR is an important metric for subscription businesses, so business owners need to be wary of some common mistakes when calculating it.

Mistake 1: Including quarterly, semi-annual, or annual contracts at full value in a single month

Even if someone pays you all the money upfront, their subscription value in MRR calculations should be divided by the intended subscription length. The reason for this goes back to one of the main uses of monthly recurring revenue - momentum measurement. You’re not trying to measure cash flow. You’re trying to measure how quickly and efficiently you’re growing. Including everything at once throws off many of your other metrics, including customer churn rate, customer count, customer lifetime value, etc.

The one place you would count all of the cash is in your bookings calculations.

Mistake 2: Subtracting transaction fees and delinquent charges

It can be tempting for founders to subtract transaction fees and delinquent charges from their MRR totals in an effort to be more conservative and accurate when calculating their metrics. While the intentions here are good, the end results are unfortunately incorrect and misleading.

Delinquent charges are in a gray area between churn and active, especially if you typically recover any failed credit card charges quickly. The problem here, though, is in an end-of-month (EOM) calculation schema, a delinquent charge is technically gone because you didn’t collect the monthly subscription from the customer. What you should instead do with your delinquent charges is to separate them out into their own category. This type of grouping allows you to accurately measure and decrease the amount of lost revenue each month due to failed or expired credit cards.

Additionally, including transaction fees doesn’t give you enough credit and hides a potential room for optimization. Sure, you’ll never get that transaction fee to 0%, but you can easily switch billing systems, spin up your own solution, etc., to optimize costs. A great concept to keep in mind is that any expense that can be optimized should be labeled as an expense and not immediately taken out of your MRR. With that logic, you should theoretically take out all of your customer acquisition cost (CAC).

Mistake 3: Including one-time payments

Essentially, one-time sales and payments aren’t “recurring”, so they don’t belong in Monthly “Recurring” Revenue. You don’t expect to receive them on a regular basis, which means that including them in your MRR calculations will inflate your revenue expectations and skew your financial model.

Mistake 4: Including trials

Perhaps the most egregious sin is including trials and their expected subscription value before they actually convert to being a customer. Doing this essentially gives you a consistently high list of “net new” customers and “churned” customers because we all know 100% of trials don’t convert.

Mistake 5: Not including discounts

Another egregious and misleading error is not including discounts in calculations. If you give someone a discount on a $100/month plan so they’re paying $50/month, your MRR isn’t $100/month; it’s $50/month. Eventually, if you took the discount away, your top-level MRR would jump by $50/month.

Five types of MRR

Like many other SaaS metrics, MRR has variations depending on the insights you're after. These can be expressed as actual financial numbers, or as percentages (compared to the month before) to show rates of growth or decline.

- New MRR: The MRR from only your new subscribers. When put against Customer Acquisition Cost (CAC) it will show the profitability of your new subscribers.

- Expansion MRR: The additional MRR generated from existing subscribers, usually as a result of an upgrade or renewal at a higher price. Typically this does not include subscribers who converted from a free trial, as these would be counted as new MRR.

- Reactivation MRR: The monthly revenue earned from previously churned or canceled subscriptions that are reactivated during the month.

- Contraction MRR: The total reduction in MRR due to downgrades and subscription cancellations compared to the previous month. When expressed as a percentage, this is known as ‘Churn MRR’.

- Net MRR: The combination of New, Expansion, Reactivation, and Contraction MRR. This gives an overall picture of how MRR is changing. MRR often begins with Net MRR, before digging into its constituent parts. When expressed as a percentage, this is known as ‘Net Revenue Retention’.

How to use MRR calculations to grow?

If your business follows a recurring revenue model of profitability, then calculating MRR (along with similar SaaS metrics like annual recurring revenue, or ARR) will help you understand the health of your company, set goals for the future, and determine how you'll reach those goals. Understanding MRR is important because it gives you insights into:

Product-market fit compass metric

After finding the initial product-market fit through user testing and activity, you can measure monthly recurring revenue as the main compass metric to track growth within a SaaS organization. This is because MRR is the purest measure of your revenue in a SaaS business, indicating with a high degree of certainty how your future revenue will change over time.

Product team

Building a better product will improve customer retention rate, which will prevent MRR loss. Every month your team should be incentivised by MRR to develop features and experiences to prevent MRR Churn.

Sales team

Your sales team can improve MRR by making deals with more qualified leads and emphasizing the quality of leads over quantity. Your sales and marketing teams typically will primarily be focused on net new MRR.

Critical financial metric

MRR is a crucial financial metric—it gives you the most accurate status check-up of your SaaS company. It explicitly accounts for the "recurring" components in your subscription model and for those same components on a yearly scale using ARR.

What is a good MRR rate?

Like all SaaS metrics, benchmarking MRR can be difficult as performance varies by markets, customer demographics, and stage of business. Here are some helpful guides.

- Startups and young companies should be targeting higher MRR growth rates:

ARR below $2.5m - +100% MRR

ARR between $5-15m - 45% MRR

ARR between $25-75m - 35% MRR

ARR over $75m - 23% ARR - Benchmarking against monthly ARPU is also a useful method. Again, the basic rule is the lower your comparative number, the higher MRR rate you should expect:

ARPU below £15k - 47% MRR

ARPU between $25-100k - 41% MRR

ARPU between $100-250k - 31% MRR

ARPU over $250k - 23% MRR - Clearly, the more you are spending on marketing and advertising, the higher rate of MRR you should expect:

Spend less than 20% of revenue - 21% MRR

Spend 20-40% revenue - 24% MRR

Spend 40-60% revenue - 29% MRR

Spend over 60% revenue - 73% MRR - Sales channel also impacts the MRR you can expect:

Via third-parties and affiliates - 53% MRR

Inside sales - 49% MRR

Online - 46% MRR

Field sales - 30% MRR

(Source: KeyBank SaaS Survey Results 2019)

Other key metrics to use with MRR

It’s never a good idea to look at any SaaS metric in isolation. By combining MRR with other SaaS metrics, you get a more complete picture of business performance. Here are three metrics to consider alongside MRR:

Customer lifetime value (CLV): CLV is the revenue (or sometimes profit) you can expect to receive from a subscriber over the course of their custom. As a predictive metric, it can be a complex calculation depending on what variable you use to define ‘value’. Using MRR as that value should provide a more accurate result.

Churn: Typically you’d expect high churn to result in falling MRR. But sometimes MRR can rise on the back of lower subscriber numbers if those remaining customers are paying more. This can be a useful test of the price elasticity of your product. Likewise, stable churn and improving MRR (with no price increase) is a signal that your customers are upgrading or expanding their subscription with you, which may negate spending on new customer acquisition. Read more about MRR and churn.

Net revenue retention (NRR): NRR (sometimes known as Net dollar retention - NDR) takes into account current customers who downgrade, pause, or reduce their consumption alongside those who churn. NRR is expressed as a percentage, with anything under 100% showing revenue contraction. It is an important predictor of how much your business could continue to grow from your current customer base alone. The adoption of NRR as the key recurring revenue metric marks a shift in SaaS strategy from growth at all costs to sustainable growth.

What MRR doesn’t measure

Most standard measurements of MRR only take into account committed revenue. That is the money a customer has already spent on their subscription and is being recognized on a monthly basis or the money they will spend each month for their subscription for the duration of their contract term.

But looking at MRR in isolation can be misleading; it’s important to understand the context. Not every customer starts off paying full price. Some will be lured by a discount period, while at the other end loyal customers may be rewarded with the same. And it’s not uncommon for subscribers on the verge of churning to be sweetened by a temporary halt on their payments. All of this will reduce MRR in the short term, but for good reasons.

Or things can go the other way. SaaS businesses can make money outside of subscription revenue; a subscriber may make a one-off purchase, like the cost of setup, technical support for an incident, user training, or new feature enablement. MRR does not take into account these kinds of purchases, but they are clearly contributors to and measures of revenue growth.

Another consideration for calculating MRR is when in the month you recognize the revenue. For annual or multi-year subscriptions where revenue is being recognized monthly, a SaaS business has control over what day that happens. But where customers pay on a monthly basis, the billing date is normally determined by when the customer took out the contract. So revenue will be recognized all through the month, meaning your MRR will fluctuate depending on what day you assess it.

Five ways to increase your monthly recurring revenue

Improving your MRR isn’t easy, but it’s worth the effort. Here are two things you can do right now to improve your monthly recurring revenue.

1) Reinforce your value

Nothing kills MRR growth like churn. Some churn is unavoidable, especially if you’re targeting quantity of subscribers over quality. But reinforcing the value of your product can help you to persuade customers who are thinking of leaving to change their minds. To achieve this, you need a great product and customer service, combined with customer communications that highlight the key benefits of your product.

2) Get your pricing strategy right

Setting the right price for your product is not an exact science. Some prospects will always find it too high, whereas others would be willing to pay more. Continually testing different price points will get you closer to the sweet spot where you're maximizing MRR.

3) Make it easy for customers to scale their usage and spend

Make it easy for your subscribers to access the next level of service. Introducing tiered packages - where your customers pay incrementally to access more of your service, or usage-based pricing based on the number of users and how much they are consuming - creates a scalable revenue model.

4) Identify and nudge upsell opportunities

Whereas effective marketing and a product-led growth strategy can build MRR by adding new subscribers, sometimes the big wins come from targeting existing accounts that have more budget to spend. Identifying these can be as simple as comparing their current spend with you to their relative spending power. A dominant brand generating a low MRR could be ripe for expansion. Look at usage - be it people, time, or compute - to identify subscribers that are becoming more reliant on your product. Depending on the size of the opportunity, it may be better to navigate these targets away from your automated upgrade flow and have offline conversations with them to negotiate a bespoke (and more profitable) package.

5. Make sure you’re calculating MRR correctly

As mentioned in the first few paragraphs - many companies are calculating things incorrectly. These aren’t just new kids on the block– we’re talking about some companies that have closed C rounds or are of that size.

Additionally, a study of the billing platforms that include these analytics (Recurly, Zuora, etc.) and of some tools that integrate with billing platforms, revealed numerous of the mistakes above.

Each of these MRR growth tactics should be measured individually to understand which are working well and where to direct attention and budget.

To sum it up

There’s so much more to explore and discuss concerning MRR and subscription business metrics. We’ll be sure to bring you more and more as the weeks and months move on, but remember that in this game, we call SaaS momentum and subscription is the supreme focus.

In the meantime, check out our free SaaS tool for Stripe that builds out your waterfall above. Go get your SaaS in gear.

MRR FAQs

What is the difference between ARR and MRR?

The difference between ARR and MRR is that annual recurring revenue is calculated annually and represents a company's recurring revenue on a macro scale. On the other hand, MRR stands for monthly recurring revenue and is calculated monthly. As such, MRR is seen as a company's recurring revenue on a micro-scale.

How do you calculate monthly recurring revenue in SaaS?

To calculate MRR for your SaaS business, you can use the MRR formula. Simply multiply the total number of monthly users with an average monthly revenue per user:

Monthly ARPU x Total # of Monthly Users

Is MRR recognized revenue?

No, MRR is not reported in the company's financial statement in accordance with the Generally Accepted Accounting Principles (GAAP).